The perfume market in the Arab world stands out as a platform for creativity and innovation. Perfumes are not just scents but an integral part of the Arabic identity and heritage. It is where tradition meets modernity to create unique fragrance experiences that touch both the soul and senses.

In this article, brought to you by Jasmine, we explore the size of the perfume market in the Arab world, uncovering real statistics and figures that offer a comprehensive understanding of the market’s dynamic and the consumer trends that shape it.

By these lines, we aim to provide investors, entrepreneurs, and industry enthusiasts with valuable insights to help them better understand how the market responds to economic and social shifts.

To discover what’s happening in the Arab perfume market, stay with us.

Perfume Market Size in the Arab World

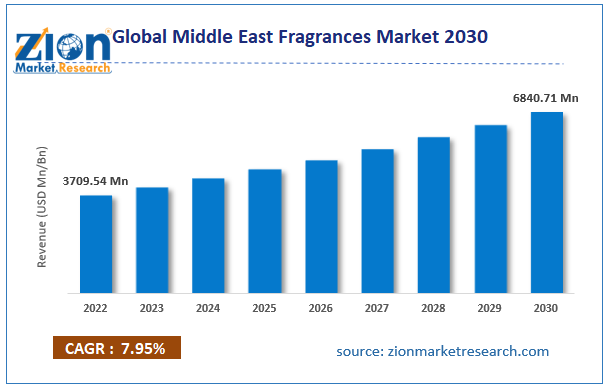

The real statistics and figures show significant growth in the Arab perfume market, reflecting ongoing development in the industry. According to data, the size of the perfume market in the Middle East was estimated by $3.71 billion in 2022, and it is expected to rise to $5.01 billion by 2023, with a compound annual growth rate of 7.95%.

This increase reflects the growing interest in luxury perfumes and rising disposable incomes in this region, directly contributing to expanding the consumer base and driving the industry’s growth.

Here are a few key points about the perfume market in the Arab World.

- Growing Demand: The increasing interest in luxury perfumes and high-quality ingredients drives growth in the market.

- Innovation and Expansion: Perfume manufacturers strive to innovate new products and expand their presence in the Arab markets.

- E-commerce Effect: Online sales are increasingly important in distributing perfumes, providing easy access to regional customers.

By understanding these dynamics, investors and entrepreneurs can seize emerging opportunities and support their business growth in the Arab perfume market.

In the following lines, we provide more details about some Arab countries.

Saudi Perfume Market Size

In Saudi Arabia, the revenue of the perfume market is expected to reach $ 0.50 billion in 2024, with tge market anticipated to witness an annual growth rate of 3.33% between 2024 to 2028

Regarding revenue per capita, it is estimated that each person in Saudi Arabia will contribute $13.47 in 2024. The same year, non-luxury perfumes are expected to account for 60% of the perfume market sales. The Saudi perfume market is experiencing a high demand for luxury perfumes, particularly those made from our, among residents and tourists.

UAE perfume Market Size

The perfume market in the UAE is expected to generate revenues of $ 142.60 billion in 2024.

However, forecasts indicate a compound annual growth rate (CAGR) decline of 0.91% from 2024 to 2028.

Regarding revenue per capita, the perfume market in the UAE is estimated to contribute $14.86 per person in 2024. Additionally, non-luxury perfumes are expected to account for about 65% of the market revenues by 2024. The UAE perfume market is also seeing a shift towards luxury and niche luxury perfume brands, catering to the needs of the country’s affluent consumer base.

Perfume Market Size in Dubai

The size of the Dubai perfume market exceeded UAE 21 billion in 2022. These figures indicate that Dubai holds the largest share of the UAE perfume market due to its strong focus on tourists and international trade.

As a global hub for shopping and travel, Dubai attracts many tourists who directly contribute to the increase in the sale of luxury and specialized perfumes. The city is also known for its numerous high-end malls and international brand stores that showcase the latest and finest perfumes, making it a key destination for perfume enthusiasts worldwide.

Egyptian Perfume Market Size

In Egypt, the perfume market is expected to generate revenues of $8.14 million, with a compound annual growth rate (CAGR) of 6.67% from 2024 to 2029. The market size is projected to reach $11.24 million by 2029.

The number of perfume consumers in Egypt is expected to reach 6.7 million by 2029, increasing from 4.5% in 2024 to 5.5% by 2029.

The perfume market in Kuwait is experiencing steady growth. Revenue is expected to reach approximately $81.52 million in 2024 and a compound annual growth rate of 3.79% from 2024 to 2028.

Regarding revenue per capita, the contribution per person is expected to be 18.74 in the same year; furthermore, non-luxury perfumes are anticipated to account for 83% of the market sales by 2024.

Perfume Market in Qatar

Qatar is expected to witness significant growth in the perfume market; its revenue is estimated to reach $65.53 million in 2024, and the compound annual growth rate (CAGR) is expected to reach 5.36% from 2024 to 2028.

Regarding individual spending, the average expenditure perdus per capita in Qatar is expected to reach $23.94 in 2024. Additionally, non-luxury products are projected to account for around 58% of total market sales by 2024.

The increasing demand for luxury, niche, and handmade perfumes shows that the Qatari perfume market is thriving, with expectations for further growth and development.

How Big is the GCC Perfume Market?

The perfume market in GCC was valued at $3.12 billion in 2024, and it is expected to reach $3.71 billion by 2029, with a compound growth rate of 3.58%.The high demand for luxury and traditional perfumes like ours is expected to persist.

Read Also: Wholesale Perfume Import: Tips for Companies and Entrepreneurs

How Big is the Global Perfume Market?

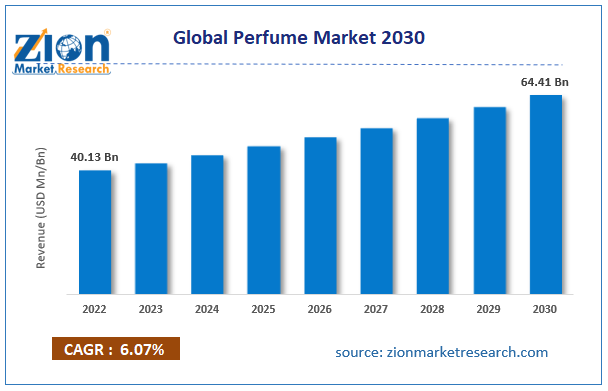

The global perfume market was estimated at around $48.42 billion in 2023, and it is expected to grow at a compound annual growth rate of 5.5% by 2023. This growth is attributed to the increasing awareness of personal care and the growing interest in luxury perfumes and innovative products among young consumers looking for unique and long-lasting perfumes.

Which Countries Use Perfume Most?

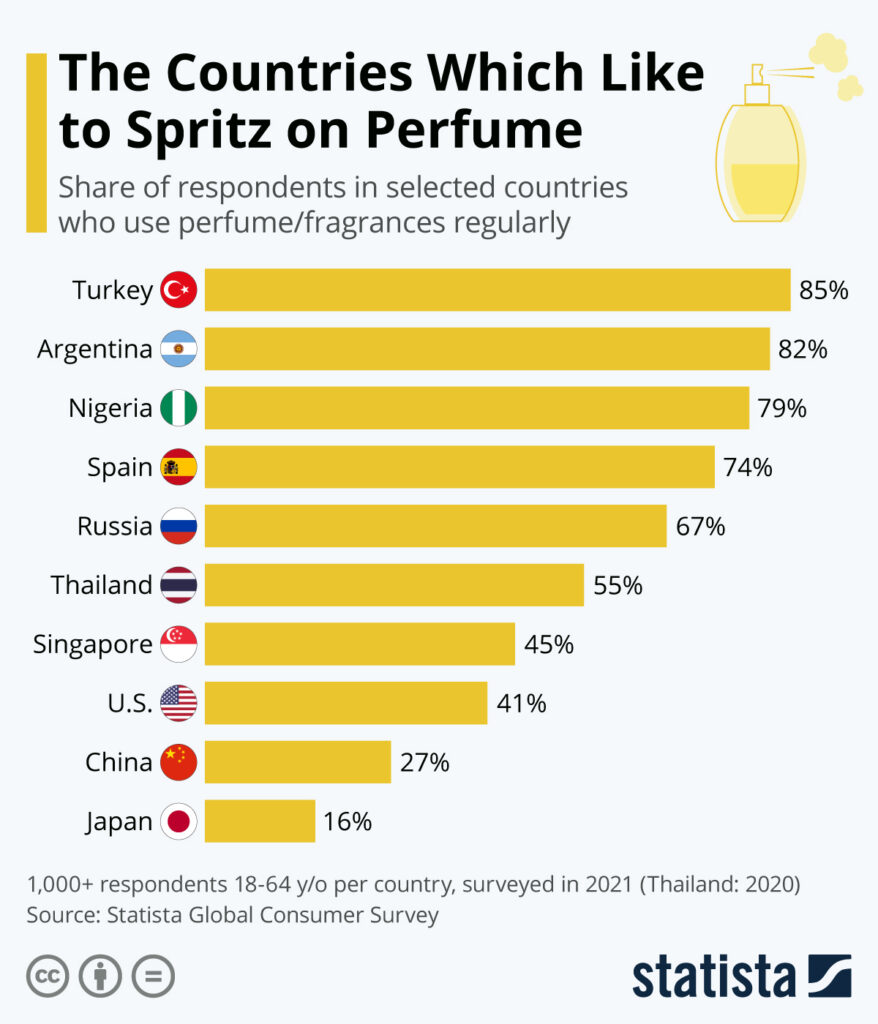

Regarding perfume consumption, the United States has the highest consumption rate.

While Europe, led by France, holds the largest share of the global perfume market, thanks to the luxury and well-known brands like Dior and Channel,

Asian countries, such as China and India, are considered the rapidly growing market due to the increase in disposable income and the rapid expansion of e-commerce platforms that provide easy access to a wide range of perfumes.

Top 20 Statistics and Figures on Perfumes

- The global fragrance market reached approximately $48 billion in 2023, with projections suggesting it will grow to $77.52 billion by 2032.

- Luxury fragrances dominated the market, accounting for over 55% of global revenue in 2022.

- In the GCC countries, people apply perfumes 2-4 times daily.

- In the United States, fragrance market revenues amounted to $8.715 million in 2023.

- In 2022, perfumes ranked as the 201st most traded product worldwide, with a total trade value of $22.1 billion.

- Online fragrance sales are expected to experience the fastest compound annual growth rate (CAGR) from 2023 to 2030.

- The German market values high-quality, eco-friendly perfumes, reflecting a trend toward natural ingredients.

- Between 2021 and 2022, global perfume exports grew by 13.6%, from $19.5 billion to $22.1 billion, with perfume trade representing 0.093% of total international trade.

- During this period, the fastest growth in perfume exports was recorded in France ($986 million), the UAE ($479 million), Spain ($424 million), Kuwait ($227 million), and Italy ($202 million).

- On the import side, the fastest-growing markets between 2021 and 2022 were the United States ($432 million), Saudi Arabia ($394 million), Spain ($205 million), the UAE ($192 million), and the United Kingdom ($178 million).

- France holds a special place as the world’s perfume capital and is home to the most renowned fragrance houses.

- Eau de Parfum is expected to be the most in-demand type of perfume, with an anticipated CAGR of 6.2%.

- In 2023, traditional retail channels dominated the market, led by specialized perfume stores.

- The fragrance market in China is rapidly growing due to shifts in consumer lifestyles and preferences.

- Current trends indicate that online sales are expected to increase significantly through 2032.

- North America and Europe lead the global fragrance market, driven by high per capita spending.

- The Asia-Pacific region is experiencing rapid growth in the fragrance market, fueled by economic development and increased consumer spending.

- The demand for fragrances in the Arab world is exceptionally high, especially for luxury and niche perfumes.

- The market is also witnessing a shift towards natural and organic perfume ingredients.

- The fragrance industry faces challenges such as high costs for luxury ingredients and stringent regulations.

These statistics highlight the dynamic nature of the perfume market and the different factors influencing its growth and transformation both globally and the Arab World.

Also read: Wholesale Buying Turkish Fragrances in Algeria: Full Guide

Importance of Knowing Perfume Statistics for Your Business Project

Knowing the statistics of the perfume market is essential for any business project aiming for success and sustainability in this field.

Here is how these statistics can benefit your project.

- Target Audience Identification: Statistics help you understand the primary consumers of fragrances in the region, enabling you to design products that directly cater to their needs and preferences.

- Marketing Strategy Guidance: By knowing which markets have the highest fragrance consumption, you can effectively target your marketing and advertising campaigns, increasing the chances of commercial success.

- Innovation and Product Development: Statistics reveal prevailing trends and the most popular fragrances, enhancing your ability to introduce innovative products that align with global and regional trends.

- Forecasting Challenges and Opportunities: Statistics help you anticipate market changes and potential challenges, allowing you to develop effective strategies to address these challenges and capitalize on available opportunities.

Knowing global perfume market statistics gives businesses a powerful tool for strategic planning and effective execution, enhancing their chances of success and expansion in a growing and competitive market.

Read Also: 6 Tips for Starting to Import Perfumes and Fresheners from Turkey

Jasmine is the best at establishing your perfume company

At Jasmine, we are a leading company in creating and building perfume brands from the ground up.

We provide comprehensive services, from developing the brand’s visual identity to manufacturing and packaging perfumes.

Here are how we can assist you if you are an entrepreneur or a startup owner in this field.

- Brand Identity Development: At Jasmine, we work on designing a unique brand identity that includes the logo, brand colors, and other visual elements that reflect the brand’s values and vision.

- Packaging and Label Design: We offer customized design services for packaging and bottles, including selecting shapes, materials, and labels that align with the fragrance and the overall brand identity.

- Perfume Manufacturing: We collaborate with experts in the fragrance industry to develop aromatic compositions in our factory that suit the target market and meet customer expectations.

- Packaging and Export: Once the perfumes are manufactured, we provide final packaging services and prepare your order for export.

By doing so, we at Jasmine offer comprehensive solutions for companies looking to enter the perfume market with a new brand or refresh their current identity, positioning them as strategic partners for success in this competitive industry.

Are you ready to start your perfume project? Contact us now, and do not delay your decision.

FAQs About Perfume Market Size in the Arab World

What country consumes the most perfume in the Arab world?

The UAE and Saudi Arabia are among the highest consumers of perfumes in the Arab World, driven by their high-income levels and deep cultural interest in perfume as an integral part of personal and social identity.

Which Country is Called the Country of Perfume?

France is renowned globally as the leading country in perfume production. It boasts a long-standing heritage in the perfume industry, with well-known brands such as Chanel and Dior.

Which is the top Producer of Perfume?

The United States is the largest producer of perfume, home to major companies that manufacture and export fragrances globally.

What is the Profit Margin on Perfumes?

The profit margin for perfume typically ranges between 30% and 50%. This margin depends on many factors, such as the type of perfume, its quality, its brand, and the pricing and distribution strategies.